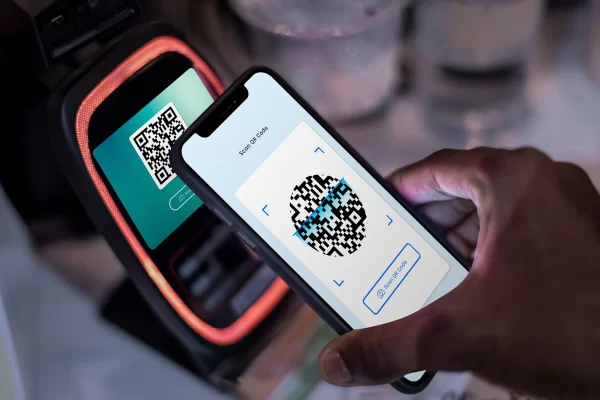

India and Singapore released on Tuesday a real-time hyperlink to facilitate less complicated go border cash transfers among one of the world`s largest recipients of remittances and an Asian economic powerhouse. Transfers of budget will now be feasible the usage of simply cellular telephones because of the tie-up among India’s Unified Payments Interface (UPI) and Singapore’s facility. Such go-border switch preparations commonly decrease fees of bills.

“This will allow human beings from each the international locations to without delay and at low-value switch budget (through) simply the usage of their cellular telephones,” Indian Prime Minister Narendra Modi stated at a digital occasion for the release of the carrier. The linkage will assist migrant workers, professionals, college students and their families, stated PM Modi.

UPI is an on the spotaneous real-time bills system, permitting customers to switch cash throughout a couple of banks with out disclosing financial institution account details. Similarly, PayNow is a carrier provided through collaborating banks that permits sending and receiving Singapore greenback budget from one financial institution to every other the usage of a cellular range.

To start with, State Bank of India, Indian Overseas Bank, Indian Bank and ICICI Bank will facilitate each inward and outward remittances whilst Axis Bank and DBS India will facilitate inward remittances, the Reserve Bank of India (RBI) stated in a statement.

For Singapore customers, the carrier could be made to be had thru DBS-Singapore and Liquid Group – a non-financial institution economic institution. More range of banks could be blanketed withinside the linkage over time, the RBI stated.

To start with, an Indian consumer can remit as much as 60,000 Indian rupees ($725.16) a day. At the release occasion, Singapore’s Prime Minister Lee Hsien Loong stated that go-border retail bills and remittances among India and Singapore presently quantity to over $1 billion annually.

“The UPI-PayNow linkage will develop in software and could make a contribution extra in facilitating trade,” Lee stated. ($1 = 82.7400 Indian rupees)