The Bank of England on Thursday introduced its largest hobby charge hike because 1989 to fight sky-excessive inflation that it warned become pushing Britain right into a recession set to final till mid-2024. Following a ordinary meeting, the BoE stated it become lifting borrowing charges through 0.seventy five percent factors to 3 percent — the best degree because the 2008 international economic crisis — to chill UK inflation that it sees quickly peaking at a four-decade excessive close to eleven percent. “It is a hard avenue ahead,” BoE governor Andrew Bailey instructed a press conference.

“The sharp boom in power expenses because of Russia’s invasion of Ukraine has made us poorer as a nation. The stage of financial pastime is probably to be flat or even fall for a few time,” he warned. The present day price boom mirrors competitive price-tightening through crucial banks international as meals expenses and power payments soar. On Wednesday, the United States Federal Reserve sprang a fourth consecutive hike of 0.seventy five percent points — and its boss Jerome Powell advised they might cross better than expected. The BoE stated British inflation might top at 10.nine percentage this year, however with the extent so excessive, analysts stated the crucial financial institution price ought to hit as excessive as 5 percentage withinside the coming months.

‘Prolonged recession’

Minutes of its assembly warned of a “difficult outlook for the United Kingdom economic system” that was “anticipated to be in recession for a extended period”, dealing a blow to Britain’s afflicted government. The BoE stated the economic system had shriveled for the reason that 1/3 quarter, getting into a technical recession this is forecast to remaining till the primary 1/2 of of 2024. The pound tumbled percentage in opposition to the greenback on expectancies of an enduring recession. “A usual textbook alternate is out of the window due to the fact currencies generally pass better whilst a important financial institution will increase rates,” stated Naeem Aslam, leader marketplace analyst at Avatrade. “Tough instances are ahead, and we’re going to see the economic system, markets, and the forex tanking withinside the coming months.” London’s FTSE one hundred stocks index fared better, dropping approximately 1/2 of-a-percentage.

Cost-of-living crisis

The BoE price boom is about to get worse a cost-of-residing disaster for tens of thousands and thousands of Britons as hikes through vital banks see retail creditors push up hobby quotes on their personal loans. “The vital financial institution has had the unenviable process of preventing hovering inflation amid full-size monetary and political uncertainty,” stated Craig Erlam, analyst at buying and selling platform OANDA. Repayments on UK mortgages have surged in current weeks additionally after the debt-fuelled finances of preceding British top minister Liz Truss spooked markets, forcing her to surrender and triggering emergency shopping for of UK authorities bonds through the BoE. Her successor Rishi Sunak has tried to convey calm to markets through hinting at tax rises in a clean finances on November 17, even supposing this sort of pass similarly harms Britain’s economy. “I suppose everybody is aware of we do face a hard monetary outlook and hard selections will want to be made,” Sunak, a former UK finance minister, informed parliament on Wednesday. British annual inflation stands at 10.1 percentage, the very best stage in forty years. As the Covid-19 pandemic commenced in early 2020, the BoE slashed its key hobby price to a record-low 0.1 percentage and additionally pumped big sums of latest coins into the economy. The Bank of England commenced elevating quotes remaining December, at the same time as Thursday’s hike turned into the 8th boom in a row. “Importantly, maximum of the tightening in coverage during the last 12 months turned into but to feed thru to the actual economy,” stated the BoE minutes.

America granted work permits for Indian spouses of h-1 b visa holders

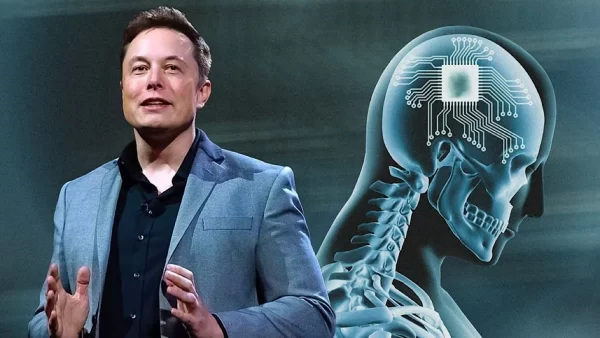

America granted work permits for Indian spouses of h-1 b visa holders  Elon Musk’s Neural ink Begins Human Trials for Brain Chip Implantation in 2023

Elon Musk’s Neural ink Begins Human Trials for Brain Chip Implantation in 2023  Trump widens lead over DeSantis in 2024 GOP presidential nomination showdown: poll

Trump widens lead over DeSantis in 2024 GOP presidential nomination showdown: poll  6 killed after work zone car crash on Baltimore Beltway, police say

6 killed after work zone car crash on Baltimore Beltway, police say  Russia’s Medvedev goes on tirade against International Criminal Court, threatens The Hague with missile strike

Russia’s Medvedev goes on tirade against International Criminal Court, threatens The Hague with missile strike  US urges Xi to press Putin over ‘war crimes’ in Ukraine

US urges Xi to press Putin over ‘war crimes’ in Ukraine